Blog Layout

Cash Flow vs Net Income

mbell • September 14, 2021

Cash Flow vs Net Income

Understanding the difference between Cash Flow

and Net Income

is a foundational step in running your business. Net Income is the first metric that business owners focus on and it truly is a good measure of the business growth. However, Cash Flow is an even more important metric that many business owners fail to track. Many business owners think that Net Income and Cash Flow are the same thing. They are interrelated but they are not the same. Think of it this way – Net Income is a point in time of your current Revenues minus Expenses whereas Cash Flow represents the ability to pay your bills. Cash Flow is dependent on timing and how much cash comes in the door and out the door which causes uncertainty in reporting.

Because Cash Flow only represents money in your bank, your business can show a profit and still have no cash. Your business could be showing a profit but if the cash flow is low, then you may still face problems. You need to address this cash flow issue. By categorizing your spending, you will gain insight into where your money is going. Then you can take control and make more informed decisions when it comes to growing your business. Working with your customers to shorten the payment cycle can speed up money in the door and working with your vendors to set a pay cycle that is longer than your receipts cycle will slow the outflow of cash. These simple steps can help you take control of your cash flow. Having control of your cash flow provides opportunities for growth and flexibility and ultimately being able to pay yourself as an owner.

By mbell

•

September 2, 2021

ClearPath Associates Fractional CFO Services are built on 4 Quadrants of Service • CFO Financial Advisory • Accounting • Bookkeeping • Cleanup and Historic Accounting With our CFO Advisory Services, we translate your data to what’s relevant for your business so that you can take the actions needed to maintain success. We focus heavily on analysis – both financially and operationally. While you’re busy working ON your business, we work IN your business focusing on analytics to protect the money your business makes and examine all the various ways you can make MORE of it. Within the broad scope of our Accounting Services, we help prepare budgets, manage cash flow, establish and monitor financial policies and procedures, create and enforce internal controls, collect and analyze financial data and profitability of key products/services. We comply with federal/state/local legal requirements and organize fiscal year-end tax information for your company’s tax preparer. Our bookkeeping services range from classifying transactions at the onset of each month to reconciling the books at the end of each month. We record and store your financial transactions, typically in QuickBooks. We manage your accounts payable and accounts receivable and can handle payroll and expense reporting. At the end of the month, your financial statements will be delivered to you. With our Cleanup Service, we “clean up” your books. We’ll take a look back to ensure that your previous bookkeepers were on top of your numbers and that your bank statements are reconciled. Although this is typically a one-and-done type service, cleanup and historic accounting could also prove important before equity/debt funding and investor presentations.

By mbell

•

August 26, 2021

Many small businesses struggle with the financial side of their business and can’t afford to hire a full time CFO, yet they need the insight of a financial expert. T he Fractional CFO is a great resource for these businesses. A Fractional CFO can provide valuable financial expertise at a fraction of the price. A Fractional CFO is one that works with many businesses for a few hours a month or a few hours a week. Assisting many other businesses provides the CFO with a wealth of knowledge over many industries as well as a diverse “rolodex” of others who they can gather advice from. The Fractional CFO can streamline your accounting processes so you can focus on revenue building and profitability. They can prepare and interpret your Financial Reports and provide vital insights. By getting you the data you need in a timely manner, you will be able to make better and more informative business decisions. A Fractional CFO only provides a portion of what a small business needs. Small businesses also need help with tactical accounting and day to day financials. This is where hiring a fractional CFO Service comes into play. ClearPath Associates provides that CFO Service. We serve the underserved market of small business entrepreneurs that just can’t afford a bookkeeper, accountant and a CFO. By hiring a bookkeeper only, the business might suffer a bit because not all aspects of the accounting and finance side are being looked at. The typical bookkeeping firm will only get you 80% to your goal. Add the CFO advisory skillset and your goals will be met!

By mbell

•

August 19, 2021

Can you answer YES to any of these questions: • Are you trying to do everything on your own? • You are a great visionary, but are you struggling with cash flow needs? • Do you need a trusted partner who is a sounding board for decision making and planning? Then you need a CFO! Typically, when a small business is in growth mode, they need a strategic partner that is numbers focused to steer them in the right direction towards profitability. Whether it is Part-Time, Fractional, or Outsourced, a CFO can help. The Chief Financial Officer title can sound intimidating to a small business entrepreneur. But don’t be scared away. The CFO can provide oversight of your financials, prepare for the future by helping you with forecasting your revenue and expenses, cash flow management, choosing a bank, securing a loan, analyzing project profitability, streamlining processes, identifying and tracking key performance metrics and other strategy decisions. A CFO can keep your business financially fit. Do you think you might be ready for CFO services? Contact us now for a free 30-minute consultation.

By mbell

•

August 12, 2021

Understanding how much cash that you need to “keep the lights on” in a business is important so that you know your break even point – where revenues equal expenses. Creating a budget will help you understand where this point is. It is also used for growth purposes so that an owner can understand what revenue they need to bring in to support hiring and investments in operations. Without a budget, a company runs the risk of spending more money than they have or not building an emergency fund or working capital. The best way to create a budget for small businesses is to start bottoms up by looking at what expenses you have or will need to run your operations. You can check your industry trends on typical costs involved in running your business. Add in costs specific to your niche as well as add in buffers for unexpected costs. The total of all of these will be your break even point. You need to at least bring in this much revenue/cash. 5 STEPS TO CREATE YOUR COMPANY BUDGET: Step 1 : Research industry trends and standards for costs and revenues. Check your industry trends on typical revenues for your size company. Ask yourself if you have a solid plan to meet that revenue goal in the next 12 months. How much profit do you want to make? Stress test these assumptions for your particular business. Step 2: Create a spreadsheet outlining your expenses and revenues expected. Some typical expenses to consider when budgeting are Costs of Goods Sold, Salary/Payroll tax, Contract labor, Rent/Utilities, Office Supplies, Software, Business Insurance, Accounting and Legal Services, Tax Payments Step 3 : Factor in a buffer to allow for unexpected changes. Add in additional costs and hold back some spending Step 4: Review your budget and look for ways to cut or delay costs. Can you reduce your rent? Can you get better payment terms with your suppliers? Step 5. Review the business budget periodically and consider developing a rolling forecast. A budget is static and is developed for the upcoming fiscal year whereas a rolling forecast is a living document that is updated regularly throughout the year to reflect changes in the industry or economy. Small business owners should review their business at least quarterly to ensure they are on track. Reviewing more than once a year allows for the business to pivot and make changes as needed to meet their goals. Still not clear on where to start? Hire a professional to make sure that you have enough money to keep the business up and running. Let ClearPath Associates help you navigate your path to profitability.

By mbell

•

August 5, 2021

So, you’ve decided to start a business. You have entertained soul-searching thoughts and brainstormed ideas. And you have landed on THE ONE! Congrats! Here are 3 main areas that you should focus on BEFORE starting your business: 1. Legal : Ensure your chosen business name is not trademarked It’s an important step to launch with the business name that you want everyone to know you by. Make sure your business name is available through the secretary of state business name search so you don’t have to change it after investing time and money in marketing your new business. 2. Tax: Register your business with the Federal government and your State and local authorities You’ll need an EIN (Employer Identification Number) to open bank accounts, apply for a business license and file your tax return. In order to request an EIN, you will need to decide on what legal structure is best for your business whether it be Sole-proprietorship, LLC, C-Corp, or S-Corp. Visit www.irs.gov to learn more. 3. Financial: Develop a business plan A high level plan will suffice when starting out. This typically includes a business summary and strategy, management team roles, financial plan and exit strategy.

By mbell

•

July 29, 2021

As a small business owner, there are a number of accounting terms that you should be familiar with. Below represents 5 of those to get you started. Cash Flow Shows the timing of cash in and cash out at any given time. As a small business owner, it is imperative that you are highly aware and focused on your cash flow. No matter how profitable you are, if you don’t have cash to cover your expenses, then your business will run into trouble. Burn Rate Measures how quickly a business is spending money. If your business is using $50,000 per month to cover payroll, rent, insurance, subscriptions, etc. and has cash reserves of $250,000, then the business will run out of cash in five months. The burn rate translates into how much revenue/cash that you need to bring in each month. Net Profit Margin How much is your company really making? This is a measure of profitability and is calculated by subtracting all expenses and costs from revenue and then dividing by revenue. For example, if a company has a 20% Net Profit Margin then it is keeping $0.20 for every $1 in revenue. Closing the Books Basically, this represents the end of the accounting cycle to prepare financial statements. The accounting cycle includes steps such as recording transactions to the general ledger, reconciling bank account statements, and making closing entries. Accrual accounting vs Cash accounting These are two different methods of tracking the company’s revenue and expenses. Most small businesses, up to $5 million in revenue, use cash accounting which records revenue when cash is received and expenses when they are paid in cash. Whereas, accrual accounting records revenues and expense when they are incurred. For example, if you complete a project in January, invoice in January but don’t get paid until February; the revenue is still recorded in January. Accrual accounting provides better visibility into profitability but requires a bit more accounting work than cash accounting.

By mbell

•

July 22, 2021

Why do I think that? I just finished watching The Queen’s Gambit on Netflix (I know – late to the game). While I have never played the game of chess, the series was intriguing and invigorating to see a strong female in the chess world that is typically male. What I learned is that the Queen is the most powerful piece in the game of chess. She has more clarity of the board which allows her more freedom to move. Similarly, when you have cash, you have freedom to be nimble in your company and invest where you see fit. But you need that clarity of the Queen to see what improvements can be made to improve operations, thereby improving cash flow. If you are burning cash to build a profit or if you are operating with tight margins, you need to know exactly how to make sure you have enough runway to keep things operating. For any business, especially small businesses, cash flow is the single most important financial metric. It doesn’t matter how great your business model is or how profitable you are. If you don’t have the cash to fund operations and make payroll, your business will not survive. Profit is on paper; cash is in the pocketbook. Cash is vital to the success of your business. Cash gives you the flexibility to invest and to survive downturns. If you manage your cash, you can survive! With cash you can do the following: 1.Invest in talent – Hire a sales team to grow top-line growth 2.Invest in growth – Buy technology to make your operations more efficient 3.Survival – Have a buffer of operating cash for those down economies How can you grow your cash when you are a small business?

By mbell

•

July 15, 2021

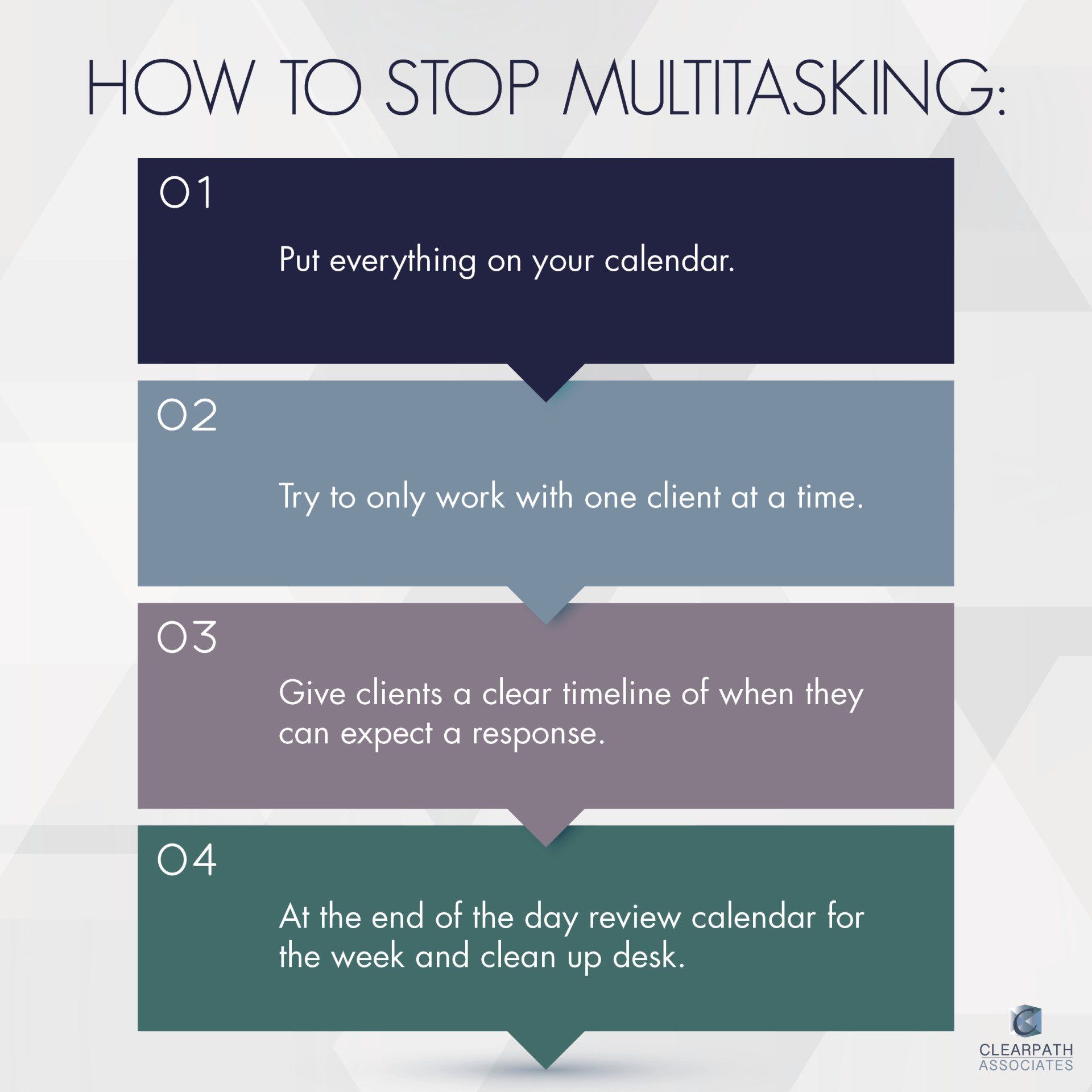

The summer months are here and are typically slower months as many of us are taking vacations. During this slower time, why not take some time to re-think how you approach your work (and life) when the work picks up again? One aspect that I find many of us struggle with is trying to do all things all of the time. I have a mug that a former colleague gifted to me years ago. How I loved and cherished the saying imprinted on it: “A multi-tasking woman is redundant”. I chuckled every time I took a sip of coffee. I flaunted it in front of my husband and boasted about how much I could handle. Well…. with several years (and age) behind me, I now realize that I was totally and completely wrong! Multi-tasking is really task-switching, and it is a productivity killer. Moving from one task to another shifts your focus and makes it difficult to tune out distractions. Research shows that when you focus on several tasks at the same time that you are actually not focusing at all and you become ineffective. It makes you less productive, less effective, and can slow down your brain. How did I stop multitasking, you ask? Well, I only get it right about 90% of the time, but I can tell I am more productive when I do. Here are a few tips that help me:

May 4, 2021

Do you want to work part time and remote? We've got a job for you! ClearPath Associates is looking for self-motivated individuals who have a passion for small business and numbers. The current need is 5-10 hours a month but has a potential to grow as we are rapidly expanding. Responsibilities would include general accounting, accounts payables, accounts receivables, journal entries, and payroll. Accounting degree required and CPA designation is preferred. Email your resume and compensation requirements to info@clearpathassociates.com .

By mbell

•

February 15, 2021

The Paycheck Protection Program is back in action for round 2 with approximately $284 billion in program funds. The SBA began accepting applications for Second Draw Loans on January 13, 2021. Do you qualify to apply? A borrower is eligible for a Second Draw PPP loan if you previously applied for and received funds from the first PPP Loan Program. The borrower must have less than 300 employees and can show that your revenues experienced at least a 25% decline on any quarter in 2020 compared to the same quarter in 2019. Loan Details If you received a First Draw PPP Loan, then you can apply for a Second Draw PPP Loan with the same general loan terms as your First Draw PPP Loan. Similar to the First Draw PPP Loan, Second Draw PPP Loans can be used for payroll costs, including benefits as will as mortgage interest, rent, utilities and certain other business expenses. For most borrowers, the maximum loan amount allowed is 2.5x the average monthly payroll costs for either 2019 or 2020 up to $2. How to Apply You can not apply directly with the SBA. You must work with an participating lender. The SBA has a great Lender Match tool to help you find a lender. However, it is recommended that you utilize the same lender that funded your First Draw PPP Loan as they will have all of your information on file. The lender that you utilize will have their own portal and process to apply. The SBA has provided a PPP Second Draw Borrower Application Form so that you can see what information will be requested of you when you apply with the lender. When to Apply The application period will be open from January 13, 2021 through March 31, 2021. But, it is strongly recommended to not wait until the last day as, in the First Draw PPP program, the funds ran out quickly. Forgiveness Terms The borrower has to show that employee and payroll levels were maintained in the same manner as required for the First Draw PPP Loan and that at least 60% of the loan proceeds were used for payroll costs and that the remaining funds were used on other eligible expenses as noted in the Loan Details. Work with ClearPath Associates and Take Advantage Navigating the PPP Loan Application process may seem daunting with understanding and capturing the correct supporting documentation required by the lender. Consulting with a qualified Financial Expert can help make the process simpler and help get your application approved.

Discover Where a Relationship with ClearPath can Lead Your Company!

Whether you require simple bookkeeping services or you’re ready to take your small business to the next level with our financial advisory services, ClearPath Associates welcomes the opportunity to customize our services to fit your needs. We offer your company a rare blend of strategy, know-how, integrity, professionalism and, believe it or not, FUN. We welcome challenges and love results – that’s good for business… your business! We can’t wait to meet you.

Discover Where a Relationship with ClearPath can Lead Your Company!

Thank you for contacting us.

We will get back to you as soon as possible

We will get back to you as soon as possible

Oops, there was an error sending your message.

Please try again later

Please try again later